There are a couple key things you need to know about ROTH vs. Before Tax when it comes to saving for retirement. Here’s what you need to know about each:

ROTH:

With a ROTH IRA, you contribute money that has already been taxed. This means that when you withdraw the money in retirement, you won’t have to pay any taxes on it.

Before Tax:

With a Before Tax IRA, you contribute money that has not yet been taxed. This means that when you withdraw the money in retirement, you will have to pay taxes on it.

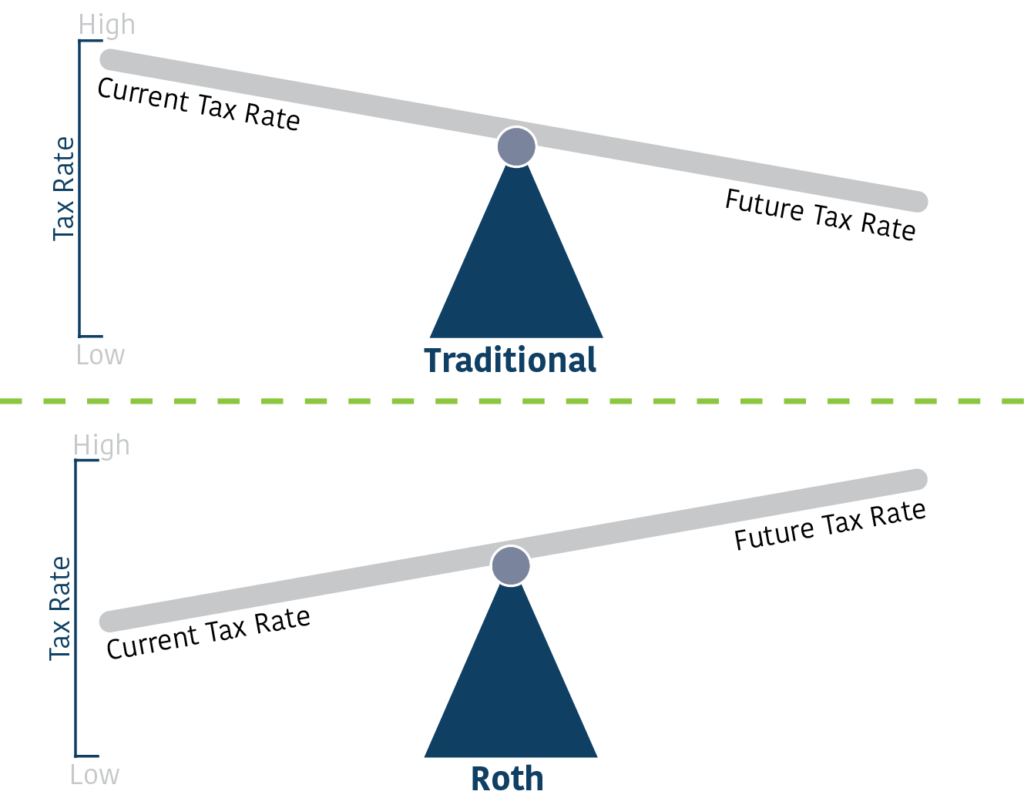

So, which is better? It depends on your situation. If you think you will be in a higher tax bracket when you retire, then a ROTH IRA may be the better choice. If you think you will be in a lower tax bracket when you retire, then a Before Tax IRA may be the better choice.

Before tax vs roth

It depends on your specific situation. If you think you will be in a higher tax bracket when you retire, then a ROTH IRA may be the better choice. If you think you will be in a lower tax bracket when you retire, then a Before Tax IRA may be the better choice.

How do you calculate your take home pay

Your take home pay is the amount of money you receive after taxes and other deductions are taken out of your paycheck. To calculate your take home pay, first calculate your gross pay (the amount of money you earn before taxes and deductions are taken out). Then, subtract any taxes and deductions from your gross pay to get your take home pay.

How much more money will you have in retirement with a Roth 401k

There is no definitive answer to this question, as it depends on a number of factors, including your tax bracket at retirement and the amount of money you have saved in your Roth 401k. However, in general, you will have more money in retirement if you save in a Roth 401k rather than a traditional 401k, since you will not have to pay taxes on the money you withdraw from your Roth 401k.With a ROTH 401k, you will have more money in retirement because you will not have to pay taxes on the money you withdraw.

What are the benefits of a Roth IRA

The benefits of a Roth IRA include the following:

-You will not have to pay taxes on the money you withdraw from your Roth IRA in retirement.

-Your money can grow tax-free in a Roth IRA.

-You may be able to withdraw your Contributions (but not your earnings) at any time without paying taxes or penalties.

-There is no required minimum distribution for a Roth IRA. This means you can leave your money in the account to grow tax-free for as long as you want.

Should you contribute to a Roth or Traditional IRA

There is no definitive answer to this question, as it depends on your personal circumstances. However, in general, a Roth IRA may be a better choice if you think you will be in a higher tax bracket when you retire. A Traditional IRA may be a better choice if you think you will be in a lower tax bracket when you retire.