Whether you are a seasoned investor, or a relative newbie, the chances are high that you have been attracted to the possibilities associated with the cryptocurrency marketplace. These unique tokens provide a host of opportunities, and the dynamic nature of mainstream tokens helps to ensure that liquidity is not an issue.

What if you are keen to add more diversity to your existing portfolio with the help of crypto holdings? Are there any ways in which you can keep ahead of the game? Let’s look at four unique solutions to understand just how rapidly this industry is evolving.

On-the-Go Trading?

We are not referring to third-party trading platforms in this sense. On the contrary, it is now possible to become immersed within the cryptocurrency ecosystem with the help of multi-asset FinTech firms such as Mountain Wolf. Some readers may already be familiar with the following services:

- The ability to obtain a physical card, or a virtual wallet.

- Worldwide payment solutions.

- Monthly top-up limits as high as $100,000 dollars.

- Systems that work in tandem with Apple and Google Pay.

- Daily spending limits tipping the scales at $10,000 dollars.

However, what you might not realise is that these very same prepaid Web3 cards can be used in real life to buy products and services like with any other credit card. In other words, they designed a solution that makes it possible to spend crypto anywhere, at the ATM, at POS or when internet shopping..

The Organic Side of Things

A significant amount of attention has been paid to recent advancements such as the growing presence of social Forex trading. The good news is that these very same opportunities are found within the cryptocurrency ecosystem. Many trading platforms provide a means to follow the experts, to keep abreast of the latest news, and even to monitor the most profitable trades. This is arguably one of the best ways for novices to wrap their heads around the finer points. After all, knowledge is power.

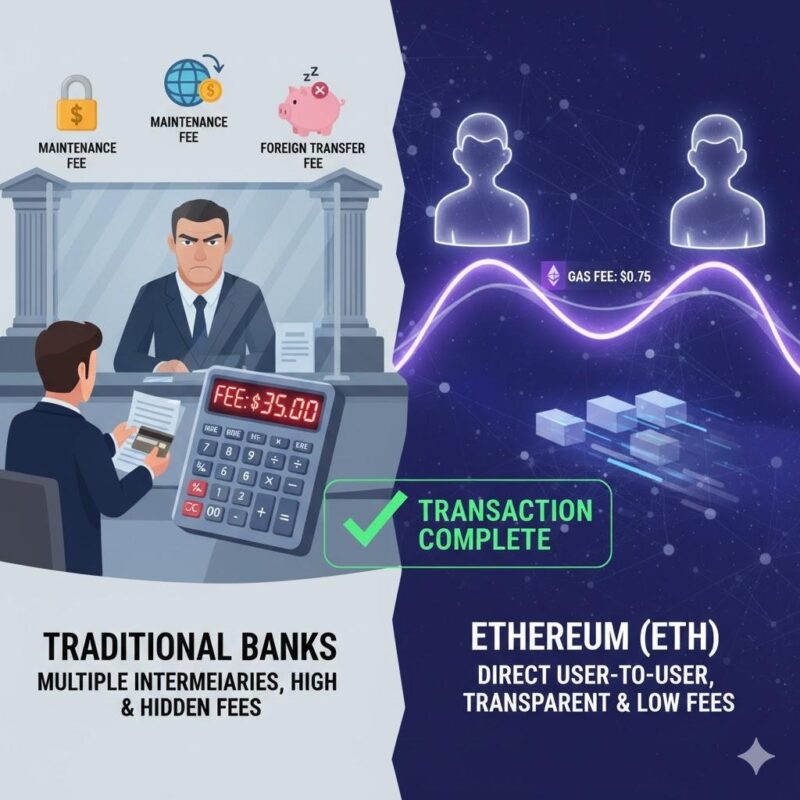

Keeping the Central Banks at Bay

Yet another way that cryptocurrency investments can work in your favour involves fiat-related concerns, including fluctuating exchange rates and hyperinflation. Mainstream tokens such as Bitcoin, Ethereum, Litecoin, and USDT are often used as a means to mitigate currency devaluations. This is obviously important for those who are hoping to make the most out of their underlying assets.

Fibonacci: The Name of the Game

Some cryptocurrency traders tend to shy away from the more technical aspects of investing; instead preferring to focus on fundamentals, or even “gut instinct”. This is a massive mistake, as user-friendly tools such as Fibonacci retracements can provide invaluable insight; regardless of one’s trading strategy. Most reputable platforms now offer these utilities as built-in features, they are excellent ways to determine the price action of a specific token. Never be afraid to delve a bit deeper, as Fibonacci lines can dramatically increase your profit margins with time.

Do not hesitate to bookmark this article, or to download it onto your computer. Innovation is the key to trading success, and the previous advice can be easily incorporated into your existing strategies.