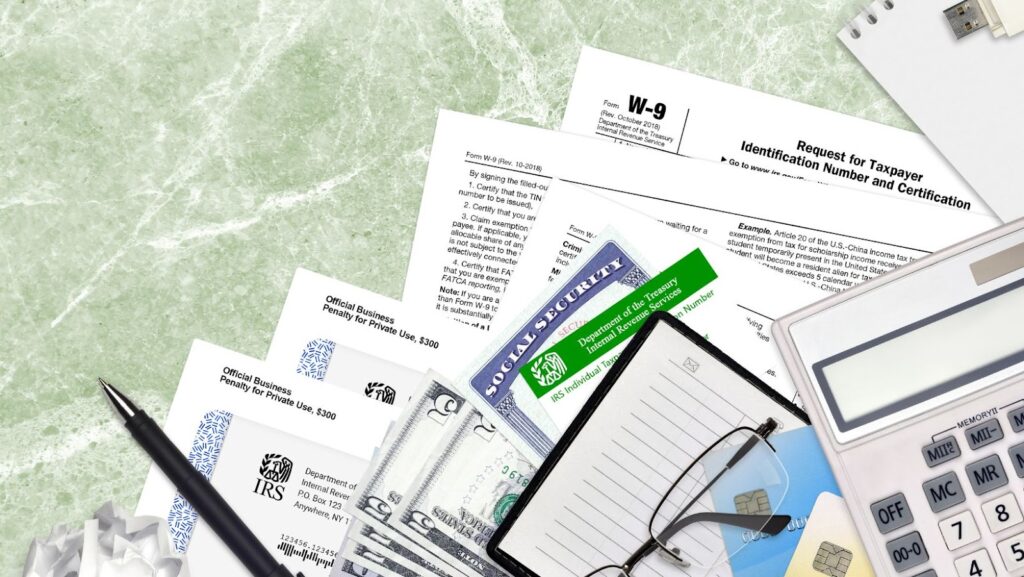

If you’ve ever filed your taxes, chances are you’ve come across the need for an ITIN number. But what exactly is an ITIN number and why is it so important? In this blog post, we’ll be breaking down everything you need to know about ITIN numbers – from what they are to how to get one. So sit back, relax, and get ready to learn all about ITIN numbers!

What is an ITIN number?

An ITIN, or Individual Taxpayer Identification Number, is a nine-digit number assigned by the IRS. It is used by people who have tax filing or payment obligations in the United States but who are not eligible for a Social Security Number (SSN).

If you are not eligible for an SSN, you can apply for an ITIN by completing IRS Form W-7 and submitting it along with your tax return. You will need to provide proof of your identity and foreign status, as well as evidence of your reason for needing an ITIN.

The main purposes of an ITIN are to ensure that you pay taxes and to provide you with a means of identification when dealing with the IRS. An ITIN does not entitle you to work in the United States or provide any type of legal status.

ITIN numbers are issued regardless of immigration status, so even if you are undocumented, you can still get one. In fact, there are many undocumented immigrants who pay taxes using an ITIN.

If you already have an SSN but are married to someone who does not, you can use your SSN and your spouse’s ITIN to file a joint tax return. This can often result in a lower overall tax bill.

Whether or not you need an ITIN depends on your circumstances. If you do need one, it’s important to apply for it as soon as possible so that you can comply with your tax obligations and avoid any penalties.

The importance of an ITIN number

An ITIN, or Individual Taxpayer Identification Number, is a nine-digit number that is assigned by the IRS to taxpayers who are required to file a federal income tax return but who do not have, and are not eligible to obtain, a Social Security Number (SSN) from the Social Security Administration (SSA).

ITINs are used by taxpayers who cannot get an SSN, such as nonresident aliens, and by resident aliens who have filing or payment obligations under U.S. tax law but who are not eligible for an SSN. Filers must have an ITIN to claim certain tax benefits, such as the Earned Income Tax Credit (EITC).

Taxpayers should apply for an ITIN if they:

-Are not eligible to obtain a Social Security Number (SSN) from the SSA;

-Are filing a federal income tax return; and

-Need an ITIN to claim tax benefits under U.S. law.

How to get an ITIN number

An ITIN, or Individual Taxpayer Identification Number, is a unique nine-digit number issued by the IRS. ITINs are for tax purposes only, and are issued regardless of immigration status, to help individuals comply with the U.S. tax code.

If you’re not eligible for a Social Security number, but you need to comply with the IRS and file taxes in the United States, you can apply for an ITIN. You use an ITIN in place of a Social Security number on your federal tax return.

To get an ITIN, you must complete IRS Form W-7 and submit it, along with your federal tax return, to the IRS. You can get Form W-7 at IRS.gov or from a certified acceptance agent.

The benefits of having an ITIN number

There are many benefits of having an ITIN number, including the following:

-You will be able to file your taxes electronically.

-You will be able to claim certain tax deductions and credits.

-You will be able to open a bank account.

-You will be able to apply for a credit card.

-You will be able to apply for a mortgage.

Can i hire someone with an itin number

Many employers require an ITIN number in order to hire you, so not having one can hurt your chances of getting hired. Additionally, not having an ITIN number means you won’t be able to get a Social Security number, which can make it difficult to open a bank account or get a loan.

The process of obtaining an ITIN number

The ITIN application process was created for two primary reasons. The first is to provide a means for those who are not eligible for a Social Security Number (SSN) to file taxes. The second is to help the IRS verify the identity of those who are claiming tax deductions or credits.

To obtain an ITIN number, you must complete and submit IRS Form W-7, which is available on the IRS website. Once your application is processed, you will be issued an ITIN number, which will be valid for five years. After that, you will need to renew your ITIN by submitting a new Form W-7.

It’s important to note that an ITIN number is not the same as an SSN, and it cannot be used for employment purposes. It’s only used for tax purposes. If you’re thinking of hiring an employee who doesn’t have an SSN, you can use their ITIN number in lieu of an SSN.

The requirements for obtaining an ITIN number

If you’re a non-U.S. resident or citizen who needs to file a federal tax return, you will need to obtain an Individual Taxpayer Identification Number, or ITIN. The requirements for obtaining an ITIN are:

You must have a filing requirement. This means that you must either have a U.S. filing obligation or meet the substantial presence test for aliens.

You must provide your original, unexpired passport or one of the following combinations of documents:

-A national identification card (if available)

-A birth certificate with your name, date of birth and place of birth

-A citizenship certificate

You must complete and submit IRS Form W-7, Application for IRS Individual Taxpayer Identification Number along with original supporting documentation, unless you qualify for an exception or renew your ITIN .